A Simple Approach to Your Complex Financial Situation

Premier Wealth Blueprint: Your Complete Solution for Financial Peace and a Secure Financial Independence

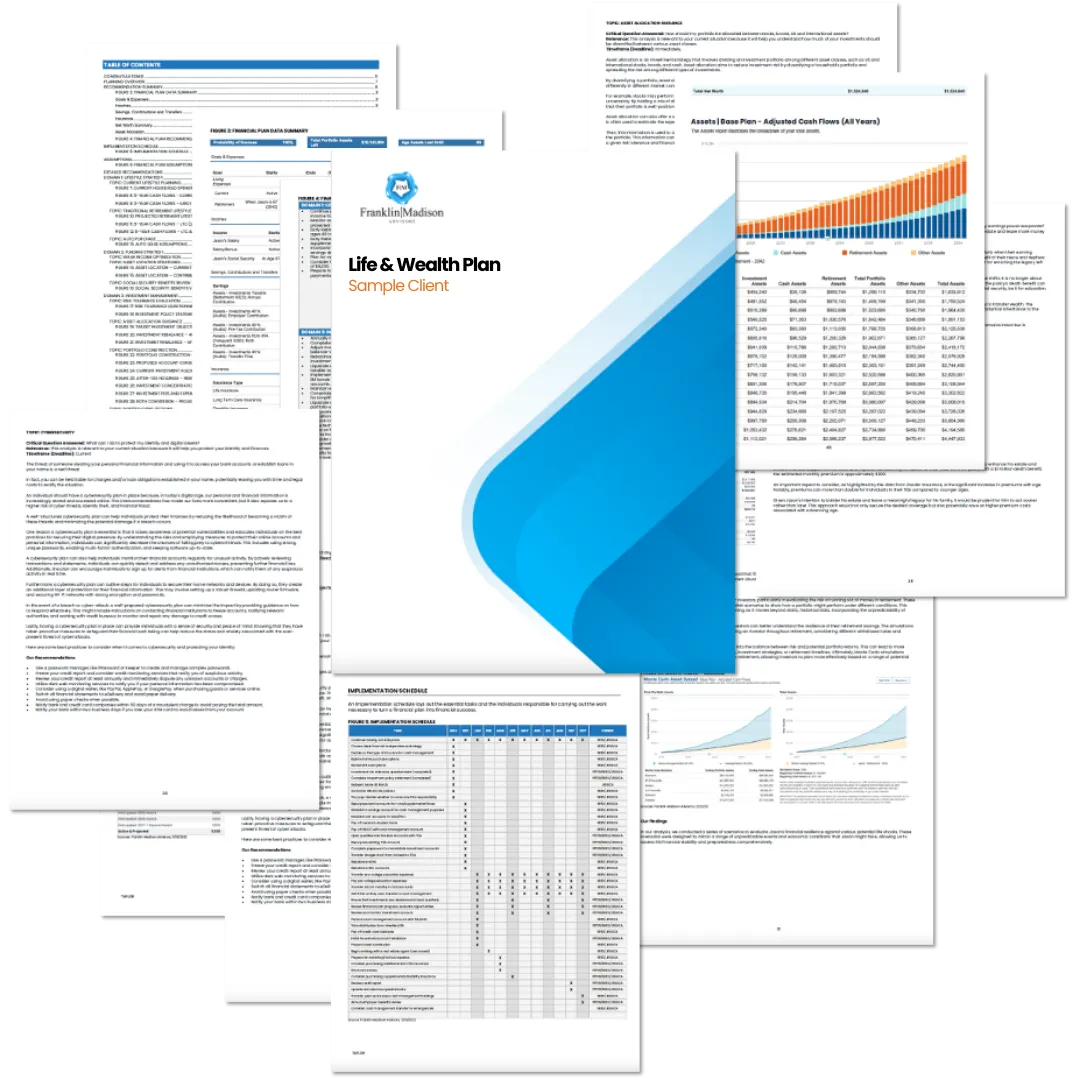

What Is the Premier Wealth Blueprint?

The Premier Wealth Blueprint is an all-inclusive approach to wealth management that helps high-achieving professionals turn financial chaos into clarity.

Because let’s face it: with your ever-evolving life and busy schedule, you need something more than a one-time financial plan or investment-only advice.

Our differentiated solution extends beyond comprehensive financial planning, professional investment management or advice-only services.

It’s an integrated, end-to-end solution that brings together these approaches in a way that’s uniquely tailored to your life situation, your needs, and finely-tuned for exactly what you’re trying to accomplish with your wealth and then seeing you through to get your advice implemented.

Managing Your Wealth Without a Blueprint Can Feel Overwhelming

Could you imagine hiring a general contractor to build your dream home who didn’t use a blueprint? Could you imagine them basing every decision from how to pour the foundation, to where to source materials, and which contractors to hire based on “gut” feel?

You wouldn’t do the same thing with your financial independence, would you?

Are you overwhelmed and unsure how to minimize the tax burden from your high-income or overwhelmed by the complexities of your employer’s stock award? The Premier Wealth Blueprint simplifies these challenges with an approach tailored just for you.

You know, managing your wealth without a plan can feel complicated. Disorganized finances, excessive tax payments, and missed investment opportunities can leave you wondering if you’re truly on the right path.

At Franklin Madison Private Wealth, we believe your money should work as hard as you do.

That’s why we created the Premier Wealth Blueprint: a personalized, actionable, and values-driven framework designed to simplify financial complexity, align your wealth with your values, and get your financial house in order and keep it that way forever.

How Does the Approach Benefit You?

Step 1: Gain Clarity by Giving Your Money Purpose

First, you’ll give your money purpose as we get to know who you are as a person and what you want your money to do for you while helping you get financially organized. Because when you have a purpose for your wealth, you’ll have clarity that every dollar saved and spent is aligned with what matters most in your life.

Step 2: Develop Confidence with a Comprehensive Financial Plan

Then, we’ll custom-tailor your financial plan so that you have a crystal-clear roadmap laying out all the steps you’ll need take to get you from where you are today, to where you want to be in the future. Because when you have a tangible plan, you can stop guessing and be confident about the steps you need to take to secure your financial independence.

Step 3: Achieve Peace of Mind with a Disciplined Process

Finally, we’re personally invested in ensuring that you’re doing the work to turn your dreams into a reality. Because when you have a disciplined process to follow, and someone to hold you accountable, you instantly gain peace of mind knowing that you can stay in the driver’s seat and know you’re working with a trusted guide who's making sure you’re making all the right moves to stay on track.

The Premier Wealth Blueprint is an end-to-end financial planning, tax planning and investment management design, planning and execution approach that transforms financial complexity into simplicity, giving you the clarity to focus on what matters most: living the life you’ve worked so hard to build.

The Premier Wealth Blueprint Solves Complex Problems

With the Premier Wealth Blueprint, our solution is specially tailored to the unique needs of accomplished professionals like you who have complicated finances:

OUR SPECIALIZATIONS

Retirement Planning

Early retirement or financial freedom isn’t just a dream—it’s a plan. We’ll:

- Design a savings and income strategy to bridge taxable/qualified account distributions.

- Stress-test your retirement plan using realistic inflation & investment return scenarios.

- Help you achieve independence on your terms.

OUR SPECIALIZATIONS

Mind Over Money

Struggling with scattered and disjointed finances? It doesn’t have to be this way. We’ll help you:

- Create a cohesive, personalized financial action plan aligned with your life goals.

- Understand how your unique money mindset impacts your financial decisions.

- Stay accountable and on track to achieve long-term financial clarity and confidence.

Your Path to Wealth Clarity Starts Here

Here’s what you can expect in the first 90-days:

- Introductory Meeting: Understand your goals and assess your current situation.

- Values & Goals Meeting: Clarify what matters most and identify priorities.

- Data Gathering: Collect and organize financial data for a solid foundation.

- Pre-Flight Check: Review preliminary insights to ensure alignment.

- Strategic Analysis: Develop a comprehensive financial plan.

- Plan Delivery: Present a tailored roadmap with actionable steps.

But we don’t stop once your financial plan is delivered. We’ll work with you step by step to overcome obstacles, make necessary course corrections and turn your plan into a reality.

In fact, we’ll make as many revisions to your financial and investment plan as necessary to ensure our guidance practically aligns with your needs.

A Premier Wealth Blueprint to Get Your Financial House in Order and Keep it that Way Forever:

- A purpose-driven financial framework tailored to your needs.

- Organization of financial documents and streamlined asset management.

- A detailed, actionable financial plan.

- Monthly action schedules for Year 1, transitioning to maintenance in Year 2+.

- Proactive advising for adjustments as life changes.

- Annual tax planning and ad-hoc meetings.

- Referrals and support for estate and insurance planning.

- Professional investment management.

- Roth conversion implementation.

- Tax loss/capital gains harvesting.

- Comprehensive cash management solutions.

- Done-for-you tax preparation.

- Concierge services.

What Our Clients Are Saying

"Peter is always genuinely interested and concerned about us and the life we live. He is a very positive force for us to know that with what we have saved and how we have saved we will live comfortably in retirement. He is always available to hear us and will answer any of my very silly questions."

Andrea J.

"Peter's expertise in cash flow management and comprehensive planning brought new and effective ways to organize our money, and I've appreciated his flexibility in working alongside us to tailor those approaches to our specific situations."

Robert T.

"Peter takes an immense amount of time to listen and understand our specific needs and presents us with different options most of which we never knew were available as well as the pro's and cons of each. he checks in periodically above and beyond our monthly appointments and that's not something we received at the big banks before."

Elena B.

Here's How to Get Started

Step 1: Attend an Introductory Video Call

We’ll meet virtually via Zoom for 45 minutes to discuss your current financial needs and determine if we’re a good fit.

Step 2: Review and Approve Your Planning Agreement

We’ll discuss in plain English how we’ll work together, and provide in black and white your costs, and what you get right from the start.

Step 3: Get Started and Get Organized

Once you're a client, we’ll guide you each step of the way to giving your money purpose and getting your current financials organized as we prepare to develop your financial plan.

Don't Wait Another Day

Your path to securing your financial independence begins with a clear plan. With the Premier Wealth Blueprint, you’ll gain the clarity, confidence, and peace of mind you deserve.

Don’t let financial complexity hold you back another day. Schedule your consultation today and take the first step toward getting your financial house in order so you can secure your financial independence.