Get Your Financial House in Order, Live Your Legacy

You’ll receive a written financial plan that maps out how to align your wealth with your life goals.

Aligning Your Money with Your Legacy

Your life is more than a series of status meetings and emails, it’s a journey filled with dreams, milestones, and family.

At Franklin Madison Private Wealth Management, we recognize that each chapter of your life demands a unique financial strategy.

That’s why our Life & Wealth Planning service is designed to harmonize your first-gen financial goals across all stages of life, ensuring a seamless, integrated approach to your wealth management.

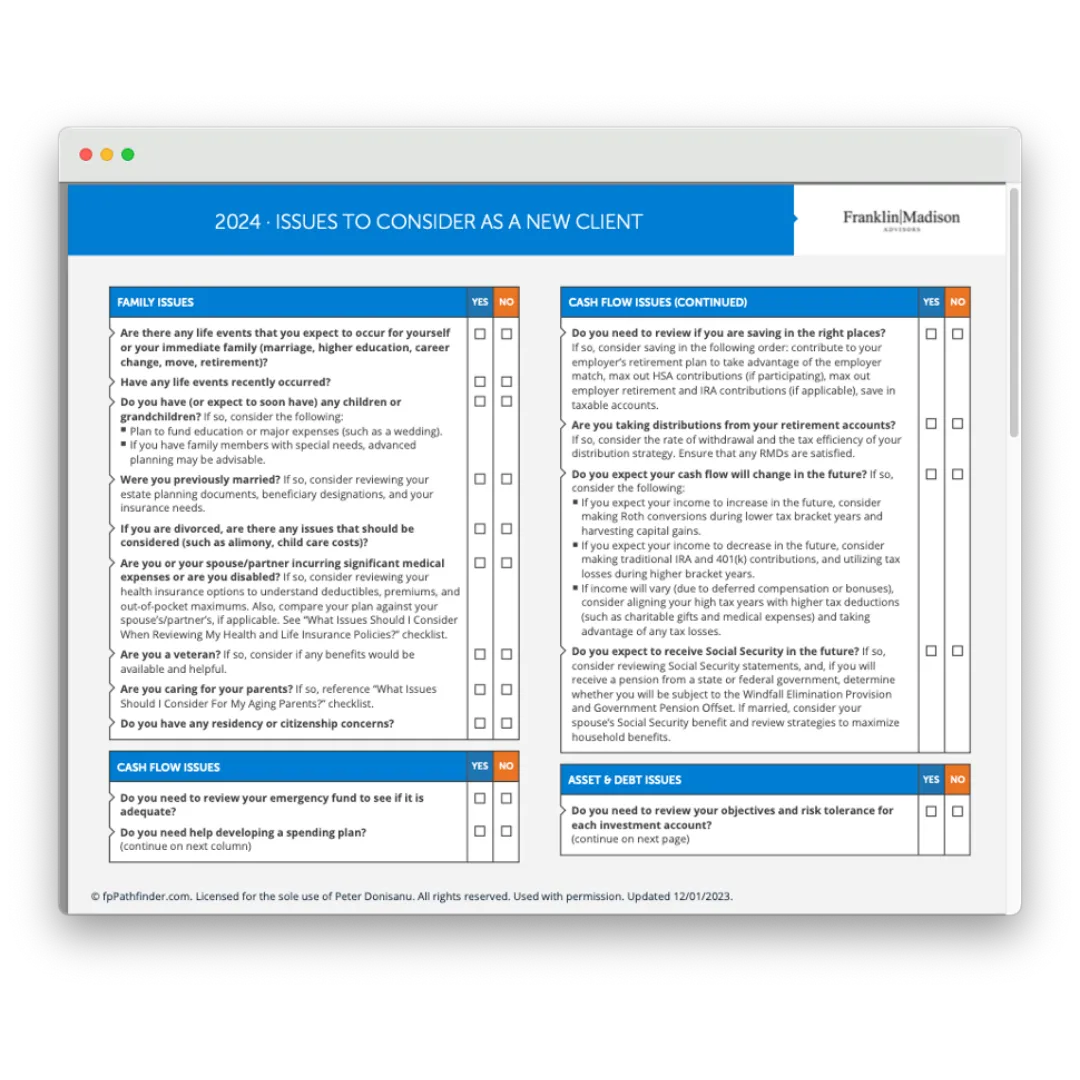

Free Checklist Download: What Every New Client Should Know

This indispensable guide is tailored for new clients, providing a thorough checklist to navigate through key considerations across various aspects of personal and financial life. From family dynamics and cash flow management to asset, debt, tax planning, and long-term goals, this checklist prompts you to reflect on a wide array of crucial questions.

What is Financial Planning? Life & Wealth Planning Services

Financial planning is a comprehensive process that involves creating tailored strategies to manage your or your family’s financial affairs.

This process involves assessing your current financial situation, identifying short-term and long-term life goals, like building generational wealth, and then developing a plan to connect the dots between your money and your life goals.

It encompasses various money topics, including investment management, tax planning, estate planning, retirement planning, and risk management.

The aim here is to optimize the acts of wealth accumulation, preservation, and transfer while also considering your unique risk tolerance, current lifestyle needs, and future aspirational and legacy goals.

Ultimately, however, financial planning is a dynamic process, requiring regular reviews and adjustments to reflect changes in financial circumstances, market conditions, and your evolving personal goals.

Crafting a Financial Plan as Dynamic as Your Life

Your life is multifaceted, and so are your financial needs.

That’s why our approach to Life & Wealth Planning isn’t just about numbers, it’s about understanding the story behind those numbers.

Here’s how our financial planning approach works:

- Holistic Financial Mapping: We start by mapping out your entire financial landscape, considering over 60 planning topic reviews, ranging from evaluating daily cash flows to long-term estate planning. This comprehensive approach ensures no stone is left unturned.

- Integrated Goal Setting: We don’t just plan for individual goals, we integrate them. This means your retirement plan works in concert with saving for your kids’ college education expenses, and your investment choices align with your legacy goals, and so on.

- Dynamic Cash Flow Management: Understanding and managing your cash flow is crucial. We’ll help you balance your present needs with future goals, ensuring you have adequate liquidity all while also growing your wealth.

- Legacy and Estate Planning: Your legacy is about more than wealth, it’s about the values and impact you leave behind. Our estate planning is tailored to capture qualitative and quantitative aspects to ensure your legacy is preserved and passed on according to your wishes.

- Continuous Life Planning: Life is unpredictable. Our continuous planning process ensures that your financial plan remains robust and flexible, ready to adapt to life’s unexpected turns.

- Collaborative Approach: We work hand-in-hand with you, respecting your insights and decisions. Our role is to guide, educate, and provide expert advice, but the final decisions are always yours.

- Transparent Communication: We believe in clear, ongoing communication. Your understanding and comfort with your financial plan is as important as the plan itself.

- Technological Integration: Leveraging cutting-edge technology, we provide you with tools and resources to monitor your financial health, giving you control and insights into your wealth journey.

- Life-Stage Adaptation: As you progress through different stages of life, your financial needs will likely evolve. Whether you’re starting a family, planning for retirement, or setting up philanthropic endeavors, our plans adapt with you.

Stay Informed and Build Your Legacy!

Subscribe to our weekly newsletter where you’ll receive actionable ideas on managing your wealth, including equity comp, taxes, investing, risk management and more to help get your financial house in order so you can live your legacy.

Your Story, Your Financial Plan

At Franklin Madison Private Wealth, we understand that your financial plan is not just a document, it’s a reflection of your life’s journey and the legacy you want to leave behind.

As you innovate and excel in your work, let us manage the complexity of your financial life with a synchronized, comprehensive approach.

Ready to align your financial goals with your life’s aspirations?

Connect with us, and let’s create a financial plan that not only meets your needs today but paves the way for building a lasting legacy.