Meet the Guide Who Simplifies Complexity and Empowers Financial Independence

Peter Donisanu built the Premier Wealth Blueprint to address a problem he saw too often in the wealth management industry: advice that missed the mark for clients who deserve better.

On a Mission to Deliver Clarity, Confidence, and Peace of Mind

Peter Donisanu, ChFC©, AIF©

Chief Investment Officer

Private Wealth Manager

Franklin Madison Private Wealth

Quick Facts

- Current Role: Principal at Franklin Madison Private Wealth (2019 – Present).

- Previous Experience: Senior Investment Strategy Analyst at Wells Fargo Investment Institute (2001 – 2019).

- Public Service: Economic Development Commissioner, Antioch, CA (2015).

- Education: MBA in Finance, City University of Seattle; BA in Business, Western Governors University; American College, Certified Financial Planner Education

- Credentials: Accredited Investment Fiduciary, Series 7 License, Series 65 License

- Public Speaking & Media: Bloomberg, Yahoo Finance, PBS Newshour, Nikkei, WSJ, Financial Times

- Personal Interests: Marathon, Ultramarathons and Triathlons.

At Franklin Madison Private Wealth, we believe your wealth should work as hard as you do. That’s why I created the Premier Wealth Blueprint—to simplify finances, align wealth with your goals, and empower you with confidence for the future.

During my two decades in the wealth management industry, I’ve seen too many clients overwhelmed by disorganized finances, paying more in taxes than necessary, and lacking the confidence to make informed financial decisions. This stemmed from generic advice that prioritized product sales or investment outcomes over meaningful results.

You’ve worked hard for your wealth, but without personalized guidance, you’re stuck guessing whether your decisions will actually get you closer to your goals.

The Premier Wealth Blueprint is my response to this problem. It’s a proven framework that transforms financial chaos into simplicity, providing clarity, confidence, and peace of mind through an end-to-end, professionally curated service.

Because if you’re not consistently executing on a clearly defined plan, then every day is a missed opportunity to maximize your wealth and secure your family’s future.

"The early phases of financial planning were incredibly eye opening! I had no idea how much value there is in future-thinking strategies like life insurance, portfolio diversifications, etc. I could tell from our first 1-2 meetings with Peter that I had a LOT to learn." – Jessica M.

A Partner in Your Journey of Firsts

Getting from where you’re at today, to where you want to be in the future is challenging, especially when you’re trying to do it all alone.

Been there, done that.

As a first-generation Romanian-American, I know the challenges of carving a path through “firsts.” Whether it’s navigating the corporate world, planning for financial independence, or building a legacy for future generations, I understand how overwhelming financial decisions can feel, especially when you don’t have anyone to show you the ropes.

In fact, the streets of Franklin and Madison are pivotal crossroads in my own life that taught me the importance of not only resilience and adaptability but the value of connecting with the right people at the right time to move my life to the next level. This realization is what inspired me to help others gain clarity about where they’re going and help them take control of their financial future.

That’s why I’ve dedicated my career to simplifying these challenges for clients like you so you can focus on what matters most in your life.

With leadership roles at Wells Fargo Investment Institute and over two decades of experience in the financial services industry, I’ve dedicated my career to delivering advice that works for you—not to further financial product sales or someone else’s bottom line.

What I’ve learned is that many individuals are yearning to work with someone who is going to give them more than generic printouts from financial planning software, they’re looking for more than guidance centered around investments, and most crucially, they’re looking for someone who gets them and can address complex financial topics like taxes, equity compensation and estate planning.

Because the fact is that you’re not just looking for financial advice—you need someone to connect the dots, simplify your already complex life, and tailor solutions to your unique station and life goals.

That’s why I created the Premier Wealth Blueprint: to provide a personalized, outcomes-based approach that helps clients get their financial house in order and keep it that way forever.

"Peter takes an immense amount of time to listen and understand our specific needs and presents us with different options most of which we never knew were available as well as the pro's and cons of each. He checks in periodically above and beyond our monthly appointments and that's not something we received at the big banks before." – Andrew F.

Learn more about how our personalized approach can simplify your finances.

A Simple Approach for Complex Lives

Step 1: Gain Clarity by Giving Your Money Purpose

First, you’ll give your money purpose as we get to know who you are as a person and what you want your money to do for you while helping you get financially organized. Because when you have a purpose for your wealth, you’ll have clarity that every dollar saved and spent is aligned with what matters most in your life.

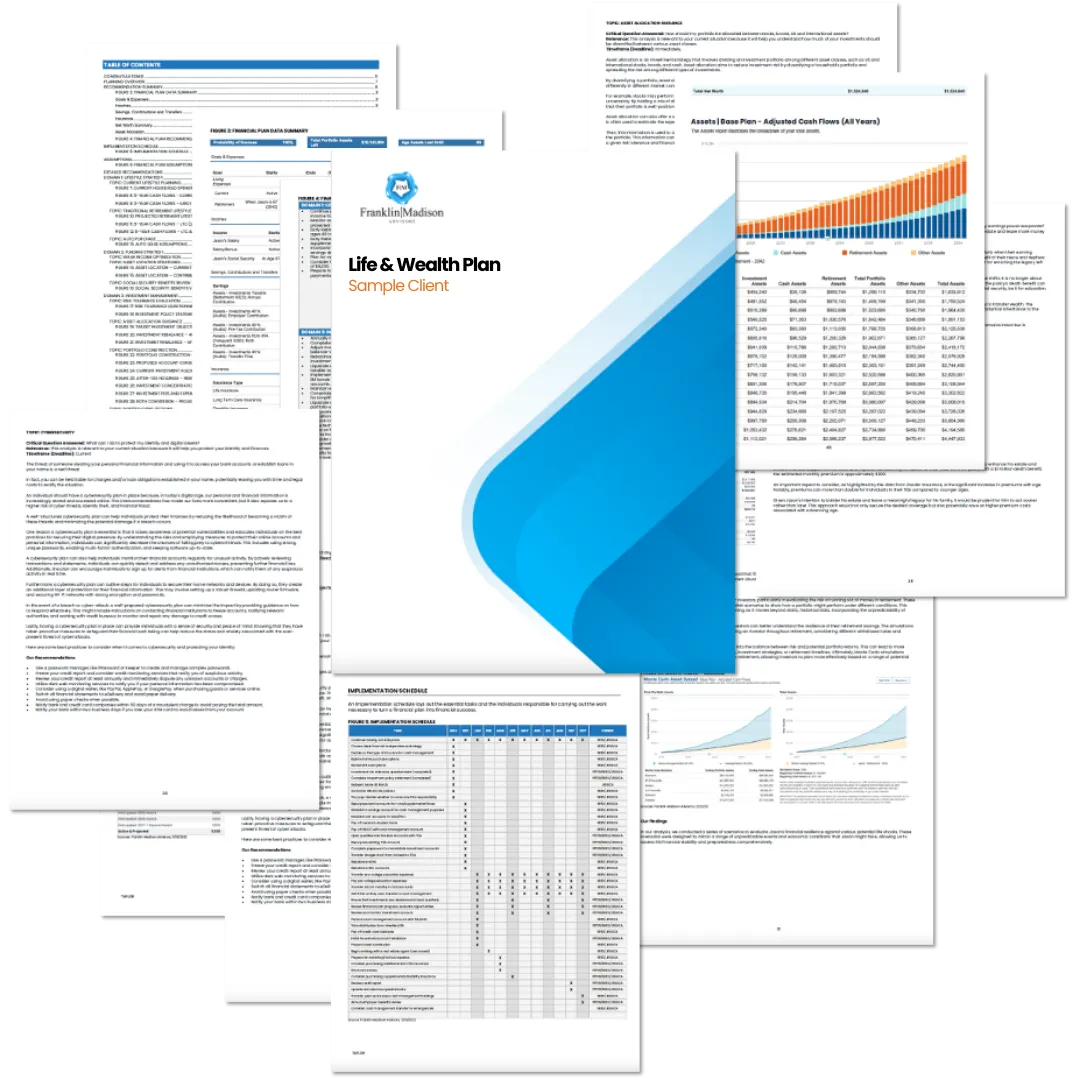

Step 2: Develop Confidence with a Comprehensive Financial Plan

Then, we’ll custom-tailor your financial plan so that you have a crystal-clear roadmap laying out all the steps you’ll need take to get you from where you are today, to where you want to be in the future. Because when you have a tangible plan, you can stop guessing and be confident about the steps you need to take to secure your financial independence.

Step 3: Achieve Peace of Mind with a Disciplined Process

Finally, we’re personally invested in ensuring that you’re doing the work to turn your dreams into a reality. Because when you have a disciplined process to follow, and someone to hold you accountable, you instantly gain peace of mind knowing that you can stay in the driver’s seat and know you’re working with a trusted guide who's making sure you’re making all the right moves to stay on track.

The Premier Wealth Blueprint is an end-to-end financial planning and investment management design, planning and execution approach that transforms financial complexity into simplicity, giving you the clarity to focus on what matters most: living the life you’ve worked so hard to build.

"Peter's expertise in cash flow management and comprehensive planning brought new and effective ways to organize our money, and I've appreciated his flexibility in working alongside us to tailor those approaches to our specific situations." – Robert T.

Explore how the Premier Wealth Blueprint can transform your financial future.

Beyond Wealth Management

On a more personal note, I’m a devoted family man and live in Pittsburgh, PA, with my wife (Jaci), three young children (Lily, Mae and Jack), and dog (Sprouts). When I’m not cherishing time with my family, you’ll find me pushing my limits on the roads and trails and training for ultras and endurance races that fuel my passion for discipline, perseverance, and adventure.

And just as I train for endurance races with discipline and focus, I bring the same approach to helping clients navigate their complex financial lives—ensuring every step of the journey is purposeful and productive. At Franklin Madison Private Wealth, our goal is simple: to help you build a future where you can live your values and cherish every moment with your loved ones.

Let's work together to create a financial plan that works as hard as you do.

A Premier Wealth Blueprint to Get Your Financial House in Order and Keep it that Way Forever:

- A purpose-driven financial framework tailored to your needs.

- Organization of financial documents and streamlined asset management.

- A detailed, actionable financial plan.

- Monthly action schedules for Year 1, transitioning to maintenance in Year 2+.

- Proactive advising for adjustments as life changes.

- Annual tax planning and ad-hoc meetings.

- Referrals and support for estate and insurance planning.

- Professional investment management.

- Roth conversion implementation.

- Tax loss/capital gains harvesting.

- Comprehensive cash management solutions.

- Done-for-you tax preparation.

- Concierge services.

Here's How to Get Started

Step 1: Attend an Introductory Video Call

We’ll meet virtually via Zoom for 45 minutes to discuss your current financial needs and determine if we’re a good fit.

Step 2: Review and Approve Your Planning Agreement

We’ll discuss in plain English how we’ll work together, and provide in black and white your costs, and what you get right from the start.

Step 3: Get Started and Get Organized

Once you're a client, we’ll guide you each step of the way to giving your money purpose and getting your current financials organized as we prepare to develop your financial plan.

Don't Wait Another Day

Your path to securing your financial independence begins with a clear plan. With the Premier Wealth Blueprint, you’ll gain the clarity, confidence, and peace of mind you deserve.

Don’t let financial complexity hold you back another day. Schedule your consultation today and take the first step toward getting your financial house in order so you can secure your financial independence.