A Proven Path to Financial Simplicity and Control

Premier Wealth Blueprint®: A Complete Tax Planning, Financial Planning and Investing Solution to Get Your Financial House in Order and Keep it That Way Forever.

Step 1. Define Your Money's Purpose

Step 2. Get a Custom-Tailored Financial & Tax Plan

Step 3. Execute a Disciplined Process

Step 4. Achieve Financial Peace of Mind

Managing Your Wealth Without a Plan Can Feel Overwhelming

Without personalized financial advice…

- You waste time on approaches that don’t apply to you

- Your investments are misaligned, and you miss out on opportunities

- You end up paying more in taxes than necessary

- You lose confidence in your spending and savings decisions

We understand that managing a complex financial situation alone can be overwhelming and frustrating, especially when you don’t have the bandwidth to give it your full attention. We believe your time should be spent living your ideal life, not worrying about your financial future.

With our Premier Wealth Blueprint®, we’ll help sort out the important details, so you can focus on what truly matters most to you. Schedule your personalized consultation today and take the first step towards securing a worry-free financial independence.

Premier Wealth Blueprint®: The Simple Answer to Complex Finances

At Franklin Madison Private Wealth, we know financial success shouldn’t feel like a burden. That’s why we created the Premier Wealth Blueprint® – a proven framework to help you regain clarity and take control over your finances.

Step 1: Gain Clarity by Giving Your Money Purpose

Get clear about where you’re going and how you want your wealth to help get you there.

Step 2: Develop Confidence with a Comprehensive Financial & Tax Plan

Know that you’re paying the right amount in taxes and not wasting time moving towards your life goals with a custom-tailored plan.

Step 3: Achieve Peace of Mind with a Disciplined Process

Navigate life's surprises and uncertainties with ease knowing you can call on a trusted advisor when you need it most.

The Premier Wealth Blueprint® is an end-to-end financial planning, tax planning & investment management design, planning and execution approach, fully curated by your own private wealth manager, that transforms financial complexity into simplicity, giving you the clarity to focus on what matters most: living the life you’ve worked so hard to build.

Peter Donisanu, AIF©

Chief Investment Officer

Private Wealth Manager

Franklin Madison Private Wealth

Your Trusted Partner in Securing Financial Independence

With over two decades of financial services experience, and trusted by the media and clients alike for our expertise, we offer a proven process that can help you get your financial house in order and keep it that way forever. Our practice utilizes best-in-class technology to model quantitatively driven financial strategies to help you save money and preserve your wealth for the long-term.

And as a fiduciary, we have a legal responsibility to always act in your best interest. Clients trust us to simplify complex financial challenges, pay no more tax than necessary and align their wealth with their life goals.

Explore how the Premier Wealth Blueprint® can transform your financial future.

OUR SPECIALIZATIONS

Retirement Planning

Dreaming of early retirement? Develop a simplified retirement savings and income strategy based on real-life scenarios and probabilities, not guesswork.

OUR SPECIALIZATIONS

Tax Planning

Are you paying too much in taxes? Keep more of your hard-earned money working for you and ensure you pay Uncle Sam no more than his fair share.

OUR SPECIALIZATIONS

Estate Planning

Do you want to leave a financial legacy but not sure where to start? Create a framework for how your assets can be preserved and distributed in a tax-efficient manner to preserve your family’s vision.

OUR SPECIALIZATIONS

Mind Over Money

Struggling with a scattered and disjointed finances? Get a cohesive, personalized financial action plan tailored to your life goals and how you manage money so you can stay accountable and stay on track.

OUR SPECIALIZATIONS

Simplified Equity Comp

Worried about making the wrong move with your equity award? Create a plan to organize, optimize and properly diversify a significant portion of your hard-earned income.

OUR SPECIALIZATIONS

Preserving Sudden Wealth

Have you come into a large sum of money but not sure what to do next? Secure your future by strategically managing stock awards, inheritances, and windfalls from business sales so you can preserve your wealth.

Your Path to Wealth Clarity Starts Here

Step 1: Attend an Introductory Meeting

We’ll meet virtually via Zoom or in-person to discuss your current financial needs and determine if we’re a good fit.

Step 2: Review and Approve Your Planning Agreement

We’ll discuss in plain English how we’ll work together, and provide in black and white your costs, and what you get right from the start.

Step 3: Get Started and Get Organized

Once you're a client, we’ll guide you each step of the way to giving your money purpose and getting your current financials organized as we prepare to develop your financial plan.

Learn more about how our Premier Wealth Blueprint® personalized approach can simplify your finances.

"Peter is always genuinely interested and concerned about us and the life we live. He is a very positive force for us to know that with what we have saved and how we have saved we will live comfortably in retirement. He is always available to hear us and will answer any of my very silly questions."

- Andrea J.

"Peter's expertise in cash flow management and comprehensive planning brought new and effective ways to organize our money, and I've appreciated his flexibility in working alongside us to tailor those approaches to our specific situations."

- Robert T.

"Peter takes an immense amount of time to listen and understand our specific needs and presents us with different options most of which we never knew were available as well as the pro's and cons of each. he checks in periodically above and beyond our monthly appointments and that's not something we received at the big banks before."

- Elena B.

At Franklin Madison Private Wealth we know that you want financial peace of mind.

In order to get that, you need personalized financial advice.

The problem is that you don’t have as much time to manage the complexities of your wealth as you used to and so certain parts of your financial situation have likely become cluttered and disorganized.

Between taking on more responsibilities at work, and ever-changing schedules at home, you’ve got a lot on your plate.

Which probably makes you feel overwhelmed, flustered and worried about not being able to retire, right? Well, we believe that you have better things to do with your time than worrying about whether you can live the life of your dreams.

And we also understand that many people just like you are struggling with finding the time to plan their ideal path to financial independence.

Which is why with over two decades of financial services experience and trusted by the media and our clients alike for our expertise, we have a proven process that can help you get your financial house in order and keep it that way forever.

And we do it through our Premier Wealth Blueprint, here’s how:

- Purpose: First, you’ll give your money purpose as we get to know who you are as a person and what you want your money to do for you while helping you get financially organized. Because when you have a purpose for your wealth, you’ll have clarity that every dollar saved and spent is aligned with what matters most in your life.

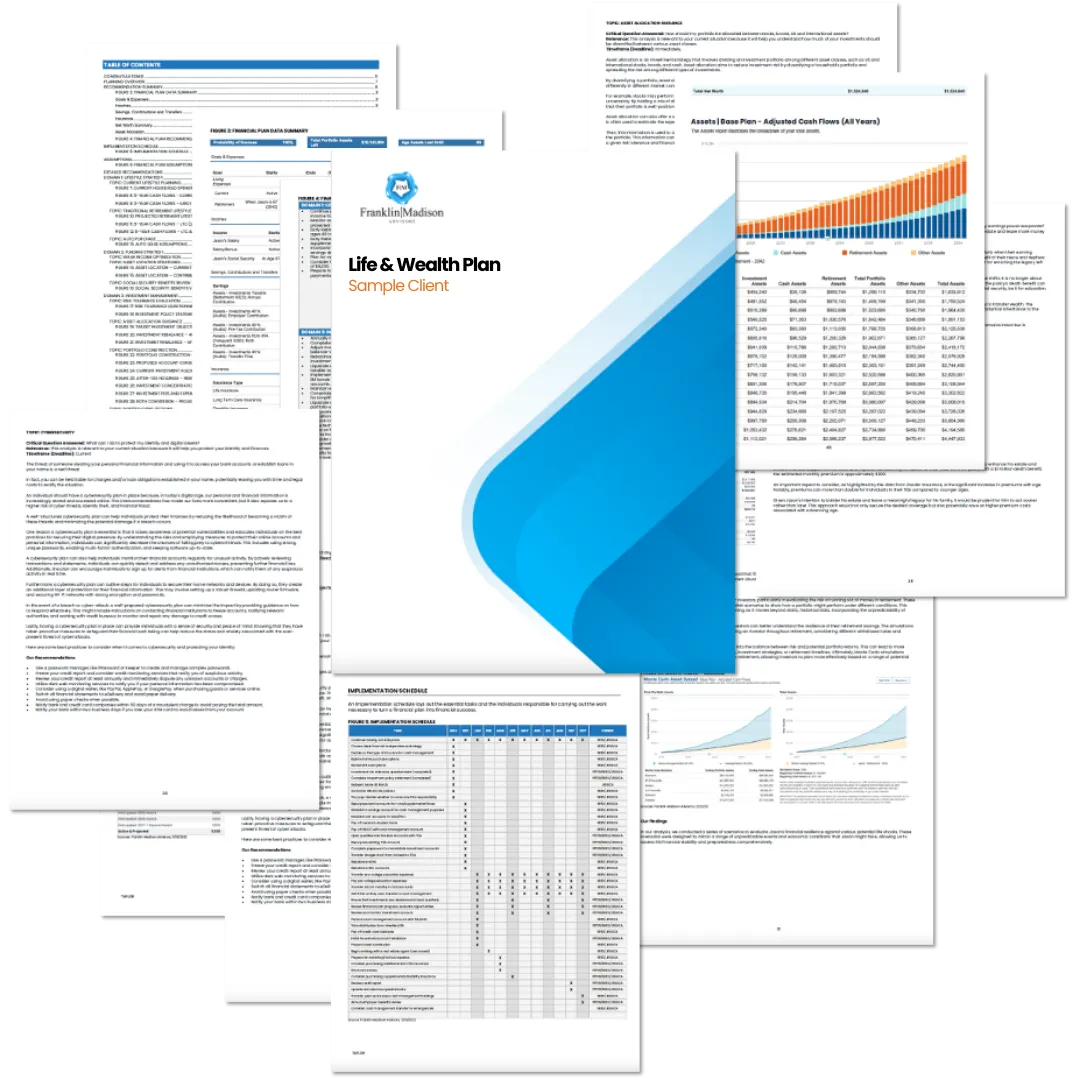

- Plan: Then, we’ll custom-tailor your financial plan so that you have a crystal-clear roadmap laying out all the steps you’ll need take to get you from where you are today, to where you want to be in the future. Because when you have a tangible plan, you can stop guessing and be confident about the steps you need to take to secure your financial independence.

- Process: And last, but not least, we’ll guide you every step of the way to turn your dreams into a reality. Because when you have a disciplined process to follow, you instantly gain peace of mind knowing that you can stay in the driver’s seat and know you’re working with a trusted guide who’s making sure you’re making all the right moves to stay on track.

All you need to do to get started is 1) schedule an introductory call, 2) confirm that our approach is the best solution for your needs, and 3) get started on your Blueprint. It’s that simple.

Let's work together to create a financial plan that works as hard as you do.

Use Our Premier Wealth Blueprint® to Get Your Financial House in Order and Keep it that Way Forever:

- A purpose-driven financial framework tailored to your needs.

- Organization of financial documents and streamlined asset management.

- A detailed, actionable financial plan.

- Monthly action schedules for Year 1, transitioning to maintenance in Year 2+.

- Proactive advising for adjustments as life changes.

- Annual tax planning and ad-hoc meetings.

- Referrals and support for estate and insurance planning.

- Professional investment management.

- Roth conversion implementation.

- Tax loss/capital gains harvesting.

- Comprehensive cash management solutions.

- Done-for-you tax preparation.

- Concierge services.

Learn more about how our personalized approach can simplify your finances.

Frequently Asked Questions

A fee-only fiduciary is a financial advisor who is paid directly by their clients for their services, and does not receive any commissions or fees from third parties for selling products. This arrangement helps to ensure that the advice they give is in the best interests of their clients, without any conflicts of interest.

- We act in your best interest at all times.

- No conflict of interest – we do not steer you toward investments where we earn a commission.

- You pay for advice and expertise – nothing hidden.

- Managing your equity compensation.

- Tax planning & strategies.

- Planning for retirement.

- Making sense of your finances.

- Selecting investments that are right for you.

- Managing your current portfolio.

- Preparing for the unexpected.

- Preparing for life changes (college, wedding, philanthropy).

Yes! No matter if your concerns are investing, taxes, cash flows or windfalls, we’ll review your entire financial situation. In fact, we take our clients through a 40-point financial inspection to ensure that all facets of your wealth are aligned with your life goals.

Schedule a no-obligation 30-minute call with us. We’ll tell you exactly what you’re going to get before you spend any money. You’ll learn which financial objectives you need to tackle in order to make your next important move.

You’ll pay us a flat monthly fee for our financial planning services. These fees are debited straight from your bank account. And if you choose to hire us to manage your portfolio, then you may choose to have fees debited directly from your investment account.